|

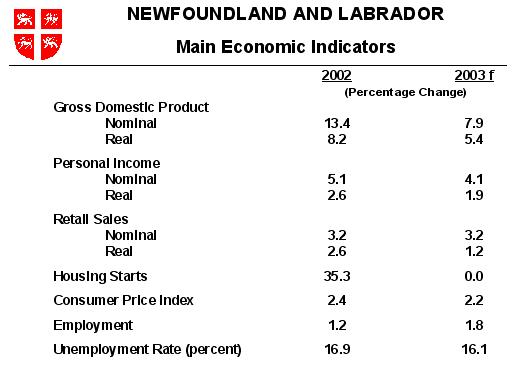

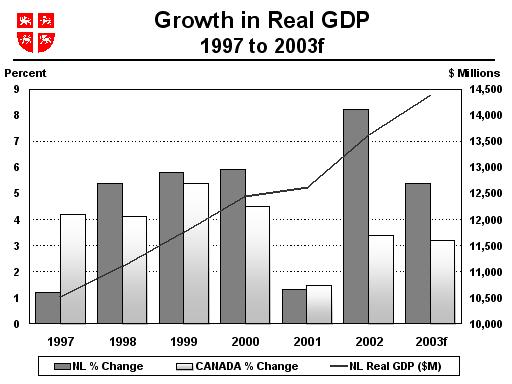

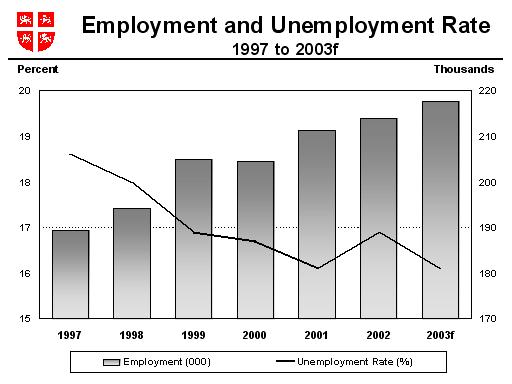

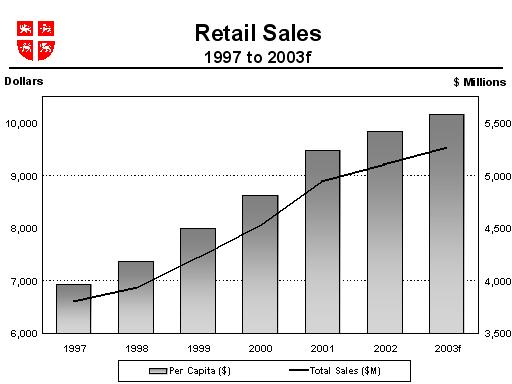

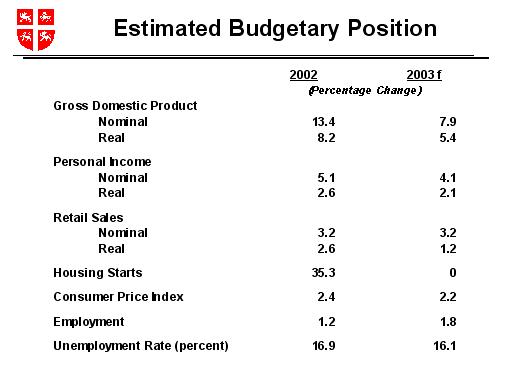

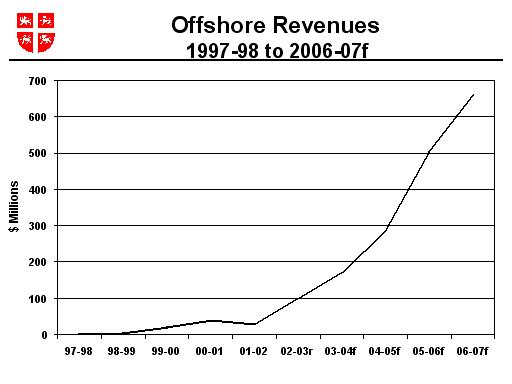

BUDGET PLAN Economic Climate - 2002 Review Mr. Speaker, when the budget was prepared last year economic uncertainties prevailed worldwide in the wake of September 11. Our economic forecast at that time for the Province was positive, but modest. Subsequent events have shown our economy was much more robust in 2002. Most economic indicators out-performed their budget forecast, some by wide margins. The Province led the country in economic growth in 2002 for the third time in five years. Our economy, measured by the change in GDP, grew in real terms by 8.2 percent, its best performance in almost 30 years. Led by growth in offshore oil production, the real value of exports rose by over 20 percent. Terra Nova produced first oil in January 2002. When combined with Hibernia, total offshore oil production reached 104 million barrels, a 92 percent increase over 2001. In March 2002 Husky Energy announced that it would proceed with development of the White Rose field, with first oil predicted in 2005. This government also reached an historic agreement in 2002 with Inco for the development of the Voisey�s Bay nickel deposit. The improving economy led to employment growth, which reached 213,900 person years, the highest level ever recorded on an annual average basis. The value of retail trade surpassed $5 billion for the first time. Economic Climate - 2003 OutlookMr. Speaker, our strong economic performance in 2002 is expected to carry over to 2003. Real GDP is forecast to grow by 5.4 percent in 2003. Offshore oil production is expected to grow by 31 percent to almost 137 million barrels. Offshore exploration activity will also increase, with two exploratory wells to be drilled in the Flemish Pass area and delineation wells drilled at White Rose and Terra Nova.

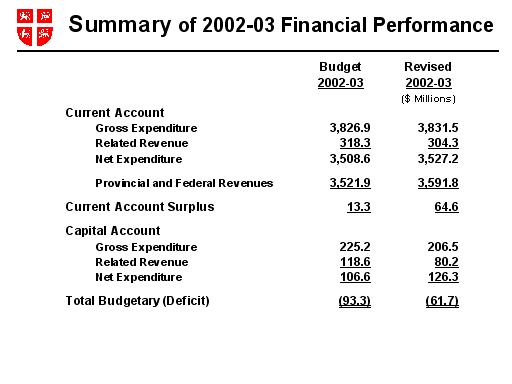

Capital investment is forecast to increase to $3.5 billion, the second highest level ever. Direct employment for White Rose should approximate 800 in 2003, with Voisey�s Bay averaging 320. Overall, employment could reach a new record high of 217,800. Business and consumer confidence remains high. This government has presided over one of the few periods of sustained high economic growth since Confederation, with real GDP growth topping the country for likely four of the most recent six years and the number of people employed in the Province reaching new highs. Fiscal Framework - 2002-03 PerformanceMr. Speaker, as well as fostering a strong economy, this government has built a record of sound fiscal performance. In the budget last year we forecast a deficit of $93.3 million in the face of the world wide economic uncertainties that followed September 11. We stated at that time we were optimistic that an economic recovery could bring the deficit down even lower. Subsequent events proved this to be correct. By year end, we anticipate revenues will be up by $176.9 million. This was all due to growth in our own source revenues. Transfers from the federal government were actually $27.4 million lower than anticipated. Expenditures should be $10.8 million lower than budget. Taken together, these developments transformed a $93.3 million budgeted deficit into a $94.4 million surplus. This surplus gave us the flexibility to take a number of measures, including not removing $97 million from the Labrador Transportation Initiative Fund. One time revenues of $57 million were deferred to the coming fiscal year, a move that mirrors a successful strategy of deficit management that we have employed before. Finally, we will make a year end contribution to the Memorial University Opportunity Fund of $2.1 million. These measures total $156.1 million and brings our surplus back to a modest deficit of $61.7 million. It is this cash deficit figure that is on a comparable basis to all those reported in every budget going back to Confederation. In fact, prior to the mid 1990s when we ushered in the most responsible period of fiscal management since Confederation, one would have to go back to 1970-71 to find a lower cash deficit. As part of our commitment to increase accountability, we are adopting budgetary policy that better reflects the norms that have become more common in other jurisdictions. To this end, commencing for the 2002-03 fiscal year we will now be including in our budgetary position borrowing for investment in certain long term assets and capital projects. These borrowings total $81.5 million and when added to our cash deficit of $61.7 million brings the consolidated deficit for 2002-03 to $143.2 million.

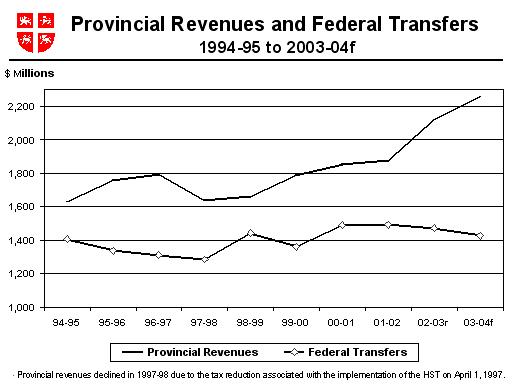

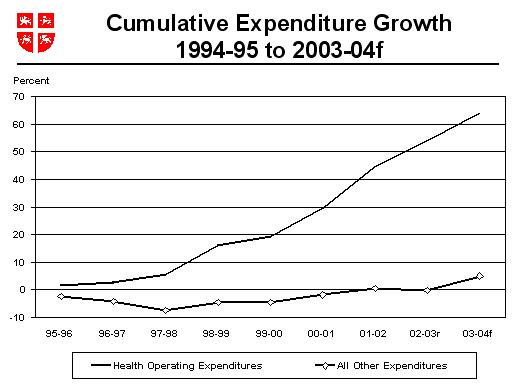

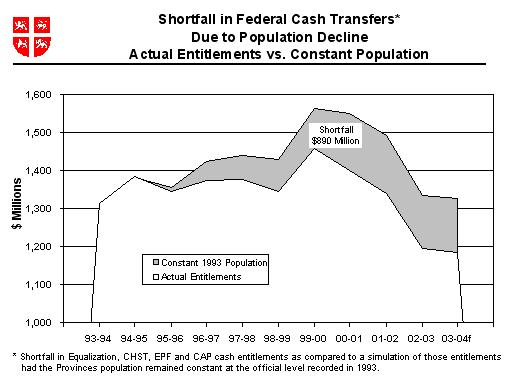

I would like to emphasize that the only thing that has changed is the way we account for some of our capital borrowings. In the past, most of the costs would have been recorded in our cash reporting as these borrowings were repaid, rather than this new practice of recording them in lump sum when the funds are first borrowed. Fiscal Framework - 2003-04 ForecastMr. Speaker, preparing any budget always has its challenges, some years more than others. For the coming fiscal year, we had a number of events that converged to put pressure on our fiscal position. Inevitably, the collapse of the groundfishery under federal management has had consequences for the Province�s fiscal position. On the one hand, the Province has had to spend more to counteract some of the economic and social consequences, while, on the other hand, a smaller population means fewer taxpayers and lower federal transfer payments which are per capita based. If our population remained at the 1994 level, for example, we would receive $140 million more in federal transfers in 2003-04 than we expect to receive. In fact, our federal cash transfers will be roughly the same in the coming year as they were 1994-95, with the transfer in support of health expenditures actually $58 million lower. Over the same period, the cost of health care has skyrocketed. This is a national phenomenon, and we cannot shelter ourselves from it. Since 1994-95 the cost of operating the health care system is up 63.6 percent, now absorbing 42 cents of every program dollar we spend. This is adding well in excess of half a billion dollars annually to our expenditures. Other than rising health care costs, which is a national issue, we have contained our expenditures. Everything else we spend on the whole range of government activities and programs, all our other expenditures, have increased in cost by only 5 percent over the same period, the equivalent of less than one percent a year. The best way that we as a government can close the gap between dramatically rising health expenditures and flat or falling federal transfers, other than cutting social programs, is to generate more revenues ourselves within the Province by growing our economy. This government has not made a practice of raising taxes. In fact, we have cut the overall tax burden, both in personal and business taxes. By growing the economy, our provincial own source revenues will see an increase in 2003-04 when compared to 1994-95 of over $625 million, approaching 40 percent.

The situation we face is rapidly rising health costs and modest growth in other expenditures, offset by strong provincial revenue growth and weak federal transfer payments. This inevitably would create a deficit gap, eventually a larger one like we face for the coming year. As our oil revenues grow, this gap can be closed, but in the interim period choices have to made. These choices are to cut social programs back now and restore them later as revenues improve, to raise taxes substantially or to incur higher deficits on a temporary basis while oil revenues grow. Mr. Speaker, this government will keep its commitments to sustain social programs. As long as the deficit is affordable and it can be eliminated over a couple of years by revenue growth, we see no reason to cut back our social programs, like health care and education, to lower the deficit now. With a reasonable expectation the deficit can be eliminated by revenue growth, any cuts would not only be unnecessary, they would be a backward step that goes against the advice given to me by the people of the Province. Let me turn briefly to why we believe a higher deficit is affordable. Our cash deficit for the coming year is forecast to be $212.7 million. We have compared this deficit to past deficits, evaluating them as a percentage of expenditures and the size of our economy as measured by GDP. Our cash deficit for the coming year is 5 percent of expenditures. From Confederation to 1994-95 the average was 10.3 percent, more than double. The only period when it has been consistently lower than 5 percent is during the term of this government. If we consider deficits as a percentage of GDP, we have the same result. Our cash deficit for the coming year is 1.3 percent of GDP. Prior to 1994-95 the average was 3.6 percent, again more than double. The only period when it was consistently lower is during the term of this government. So in terms of relative size, deficits larger than the one we are forecasting for 2003-04 were quite manageable in the past. And, these previous deficits were incurred during times when there was not the optimism there is today about growing oil revenues and our buoyant economy. Certainly, I do not wish to imply that a deficit in the $200 million range is insignificant or that we are simply dismissing it. This government takes prudent financial management very seriously. Both major US rating agencies upgraded the Province during our term in office. Our credit rating is now the highest it has been since we became a province. Part of the reason for this is that this government is the most fiscally responsible in the history of the Province. Anyone who looks at our record for the seven fiscal years from 1996-97 to 2002-03 can see our average deficit works out to be just over $25 million. This is an achievement for which there is no parallel since Confederation. The average deficit during the 1970s was $137.5 million, and during the 1980s was on average $208.7 million. These numbers would be much higher if they were adjusted for inflation to give a proper comparison. In many, if not most, of the years since 1996-97 there have been dire predictions annually about unmanageable deficits and impending fiscal shocks. The reliability of these fiscal fortunetellers must be suspect by now, as this government has brought in one responsible fiscal plan after another. We have consistently had better financial results than our initial deficit targets. Seven consecutive years of prudent fiscal management does not happen by good luck, it happens by good government. Rushing to cut social programs now by in excess of $200 million to achieve a balanced budget is just not good public policy. As a government, we believe there is no need to take this course of action given the positive outlook for our economy and our revenues. Accordingly, this budget contains no cuts to social programs or other public services. In fact, it enhances social programs selectively where we determined it would be prudent and responsible to do so. Improving Accountability Mr. Speaker, we will be improving accountability in this budget in several ways. This began by restating the cash deficit for the year just ending to include borrowings for certain long term capital projects. This new policy extends to 2003-04 and subsequent years. As a result, an amount of $73.9 million is being added to the cash deficit. This means that the consolidated deficit for 2003-04 based on our newly adopted reporting policy would be $286.6 million. This year we are also including for the first time a schedule in the budget document that shows our financial position on the basis of full accrual accounting. This methodology has been gradually adopted by other jurisdictions across the country. Its objective is to give a better matching of government revenues and expenditures with the periods to which they apply. Generally, the adjustments made for full accrual accounting do not affect our cash position or borrowing requirements. Government already reports on the basis of full accrual accounting in its Public Accounts, which are prepared and released annually. Deficit Reduction over the Next Mandate Mr. Speaker, if the consolidated deficit were substantially higher and our outlook not as favourable, a much more detailed plan for deficit reduction could be needed. But our financial situation, certainly when compared to past governments, is actually better than it has been for all but a few years since Confederation. What we want to achieve now is an orderly reduction in the deficit over time, while protecting social programs and public services, as well as sustaining business and consumer confidence in our future. Therefore, we are setting targets for deficit reduction that would bring us to a balanced budget over the four year term of our next mandate. If we target a modest $75 million reduction in the consolidated deficit each year commencing in 2004-05, this deficit will be eliminated over a four year period to 2007-08. We believe revenue growth could account for all of the fiscal improvement needed to eliminate the deficit, and more. For example, our current account revenues for 2002-03 were $220.9 million higher than the previous year, and we are forecasting these same revenues to be $96.4 million higher in 2003-04 than they were in 2002-03. Oil revenues will have a much more positive impact during the deficit reduction period than they had in these earlier years. The $75 million deficit reduction amount for any particular year is only a target because we have to retain the flexibility to manage the overall fiscal position for the longer term. Some years we may be able to do more, others less. Our flexibility in any year is a factor of many things that cannot be accurately predicted right now. Oil prices fluctuate. Health costs may grow or slow. The national and international economy rises and falls. Federal transfers are under review. There will be a new leadership in Ottawa. The list goes on. But, with our record of sound fiscal management, we have demonstrated to the people of the Province that they can have confidence our fiscal decisions are guided by their advice and the best interests of the future of the Province. Revenue Measures Mr. Speaker, as well as initiating no cuts to social programs or public services, we have avoided general tax increases in this budget. The budget actually contains some targeted tax relief for both individuals and businesses. It is necessary, however, to raise some additional revenues to contain the deficit while making some social program enhancements. These measures will affect only those individuals who choose to make certain discretionary spending decisions. An increase in tobacco taxes will raise an additional $10.5

million annually. The tax on manufactured cigarettes will increase

by 1.5 cents per cigarette, while the fine cut loose tobacco tax

will increase four cents per gram. Higher prices are a deterrent to

habitual smoking, particularly among young people who are the most

price sensitive. The Newfoundland and Labrador Liquor Corporation is

also being asked to remit an additional $10 million next year.

|

||||||||

|

|

|

All material copyright the Government of Newfoundland and Labrador. No unauthorized copying or redeployment permitted. The Government assumes no responsibility for the accuracy of any material deployed on an unauthorized server. Disclaimer/Copyright/Privacy Statement |