International & Canadian Economies

The Asian crisis that started in Thailand in the summer of 1997 has set

off a chain reaction reaching around the world. Much of Asia is in deep recession, the

Russian economy has collapsed and growth is slowing in Latin America. Consequently, global

economic growth prospects have been seriously dampened for the near term. Nevertheless,

growth is expected to continue, but at a slower rate than previously projected. The World

Bank now predicts that world economic output will grow by 1.8% in 1998 and by 1.9% in

1999, compared to earlier forecasts of upwards of 4% for 1998.

Canada

The Canadian economy has not escaped totally unscathed from the financial

and economic upheaval. Lower demand in East Asia has resulted in exports to that region

declining sharply. Furthermore, commodity prices are at low levels, squeezing

profitability in the resource sector and putting downward pressure on the Canadian dollar.

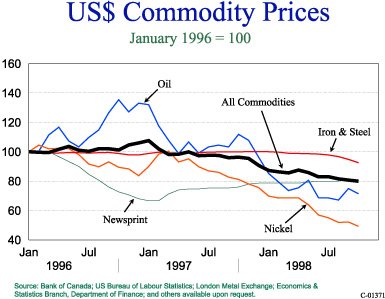

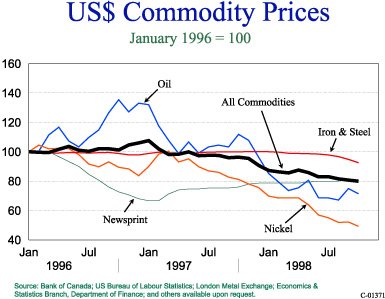

Commodity prices have been declining since late 1996

due to a buildup of excess supply which has been exacerbated by the crisis in Asia. Prices

for Canadian commodities have fallen by more than 25% in US dollars since late 1996.

Prices for crude oil, lumber, wheat and base metals have all experienced large declines.

Slow growth in the global economy will likely translate into a difficult pricing

environment for commodity producers in the near term.

Commodity prices have been declining since late 1996

due to a buildup of excess supply which has been exacerbated by the crisis in Asia. Prices

for Canadian commodities have fallen by more than 25% in US dollars since late 1996.

Prices for crude oil, lumber, wheat and base metals have all experienced large declines.

Slow growth in the global economy will likely translate into a difficult pricing

environment for commodity producers in the near term.

The Canadian dollar weakened throughout the first half of the year, the

result of falling commodity prices. In August the situation was made worse by the large

capital inflows into the United States brought on by financial market turmoil surrounding

Russia. This drove up the value of the US dollar and put downward pressure on other

currencies. The Canadian dollar kept hitting historical lows bottoming at 63.11 cents US

when the Bank of Canada boosted short-term interest rates by 100 basis points. The dollar

stabilized following the interest rate increase and by late November it was trading near

65 cents US which paved the way for some interest rate relief.

Despite some negative factors, the Canadian economy has performed well,

benefitting from a robust US economy, low inflation and buoyant domestic demand. Lower

exports to Asia have been more than offset by increased exports to the US. For the first

three quarters of 1998, real exports were up by 7%, non-residential investment was up by

7.8% and consumer spending grew by 3%. As a result, real GDP was up by 3% during the

period. Labour markets are also performing well. Employment increased by 2.7% during the

first eleven months and the unemployment rate has fallen to near 8% in recent months.

The Provinces

Slower growth worldwide and low commodity prices have mostly affected the

Western Provinces. British Columbia, which normally sends one-third of its exports to

Asia, has been particularly hard hit. Its exports to East Asia are down 29.7% during the

first nine months of 1998. Other areas of the Country appear to be less affected. The

Ontario and Quebec economies are less commodity-based and linked, to a greater degree, to

US markets. The Atlantic provinces, including Newfoundland and Labrador, have escaped, for

the most part, the significant negative impacts of the Asian Crisis. Corporate profits

have been weakened by lower prices for some products, but production volumes have yet to

be affected in a significant way. Adverse market conditions may continue to pressure

commodity-based exporters as slower global economic growth continues into 1999.

Synopsis

Financial market turmoil worldwide has impacted the global economy at

large and to a lesser degree the Canadian economy. World economic growth has been revised

downward significantly, however, the effect on Canada is not expected to be deep or long

lasting. Canada's real GDP is forecast to grow by 2.5 to 3.0% this year and by roughly 2%

in 1999. Employment growth is predicted to be 2.7% in 1998 and 1.5% next year, with the

unemployment rate averaging about 8.4% in both years.

Contents Previous Next

Commodity prices have been declining since late 1996

due to a buildup of excess supply which has been exacerbated by the crisis in Asia. Prices

for Canadian commodities have fallen by more than 25% in US dollars since late 1996.

Prices for crude oil, lumber, wheat and base metals have all experienced large declines.

Slow growth in the global economy will likely translate into a difficult pricing

environment for commodity producers in the near term.

Commodity prices have been declining since late 1996

due to a buildup of excess supply which has been exacerbated by the crisis in Asia. Prices

for Canadian commodities have fallen by more than 25% in US dollars since late 1996.

Prices for crude oil, lumber, wheat and base metals have all experienced large declines.

Slow growth in the global economy will likely translate into a difficult pricing

environment for commodity producers in the near term.